From Newsmax.com:

1. Obama, Democrats Dumped ‘Volcker Rule’

President Obama’s financial reform bill may have passed on July 15 with the support of three Republican senators, including newly elected Massachusetts Sen. Scott Brown, but the "Volcker rule" seems to have been a casualty.

As negotiations over financial reform legislation proceeded in Congress, a major point of contention emerged — the so-called Volcker rule, the New Yorker magazine reports in a feature story by writer John Cassidy.

Named for former Federal Reserve Chairman Paul Volcker, now an economics adviser to the Barack Obama administration, the Volcker rule restricted banks from engaging in risky investments like derivatives, private-equity funds, and hedge funds.

But by the time reform legislation was passed, provisions implementing the Volcker rule had been significantly watered down — thanks in part to the Obama administration’s softening of support.

The Volcker rule barred banks from speculating in the markets — proprietary trading — and from operating and investing in high-risk and highly illiquid investments.

Volcker believed the provisions would help restore the legal divide between commercial banks, which issue credit to households and companies, and investment banks, which issue and trade securities. That split had ended with legislation passed in 1999.

When President Obama in January spoke at the White House to urge Congress to enact reform — with Volcker at his side — he called for “a simple and common-sense reform, which we’re calling the Volcker rule,” Cassidy notes.

The financial industry lobbied to weaken the Volcker rule, and the Democratic leadership began to compromise to secure the vote of Sen. Brown, who sought changes to please large financial firms, some of which are based in Massachusetts.

One new provision allowed banks to invest up to 3 percent of their capital in hedge funds or private-equity funds.

Volcker expressed disappointment in the compromise, telling Cassidy: “We could have done better . . . I’m a little pained that it doesn’t have the purity I was searching for.”

The strict version of the Volcker rule was removed from reform legislation before it was passed by the Senate.

Some Democrats blamed Republicans who wanted to protect big banks. But Volcker “also suspected that some administration officials were willing to make too many concessions to Wall Street, including on the Volcker rule,” Cassidy wrote.

The administration was determined to see the legislation headed for passage before Obama attended a G-20 meeting in Toronto on the weekend of June 26. The House and Senate reached a final compromise on the bill on June 25.

“I think they had priorities that were a little different from mine,” Volcker told Cassidy afterward. “The president wanted a bill. He was going to Toronto. Everybody wanted a bill. It comes down to a squeeze play, and the 60th vote, or the person who’s perceived as the 60th vote, he’s got an awful lot of leverage.”

A READER ON THE STATE OF THE POLITICAL DECAY AND IDEOLOGICAL GRIDLOCK BETWEEN ONE GROUP WHO SEEK TO DESTROY THE COUNTRY, AND THOSE WHO WANT TO RESTORE IT.

The Rise and Fall of Hope and Change

Alexis de Toqueville

The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money.

Alexis de Tocqueville

Alexis de Tocqueville

The United States Capitol Building

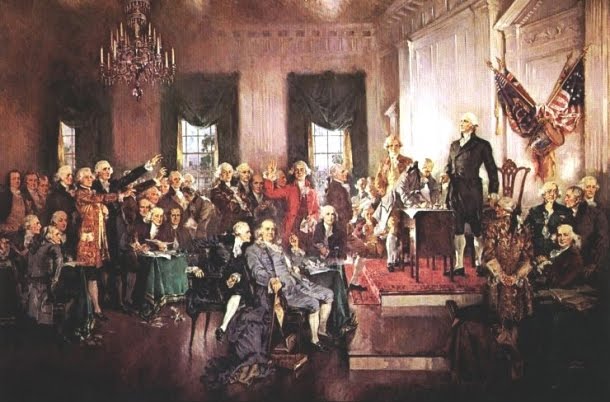

The Constitutional Convention

The Continental Congress

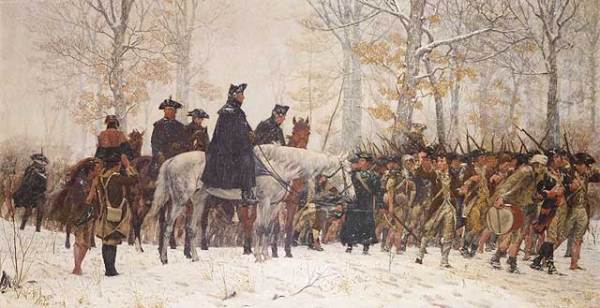

George Washington at Valley Forge

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment