from AEI:

A Conservative's Take on Social Security Reform By Andrew G. Biggs

The Atlantic

Friday, August 20, 2010

Andrew G. Biggs was interviewed by Derek Thompson of The Atlantic. Thompson offered the following introduction: "Social Security turned 75 this year, but the most important day for America's piggy bank will be in December when the president's fiscal commission could propose major and minor reforms to the program to extend its life past the 2030s, when it's scheduled to face major benefit cuts. What should the commission recommend?" Biggs's responses follow.

Should we raise the full retirement age?

If you ask people about raising it in isolation it's not popular. If you weigh with other options like increasing taxes or cutting benefits, it makes more sense. Americans are living longer. We're healthier. The capacity to work is improving, and people are working a bit longer. I think it's a good step forward.

Isn't the increase in longevity concentrated among high-earners with desk jobs that aren't physically demanding?

Valid point. Life expectancy and health are not distributed equally. You'd want to pair it with special provisions for people who can't keep working. Whatever you do, you want it to be progressive so the cut will be smaller at the bottom.

Right, progressive. I've used the word "means-test" a few times in reference to Social Security. Is that the wrong term?

Means testing means you're looking at current means, like income. But Social Security benefits are based on lifetime earnings. So technically, cuts to Social Security won't be based on current means but past earnings. Better to call it progressive indexing, which means reducing benefits for high earners.

There are a few ways to slow the growth of benefits. One is to change the benefits formula to pay high earners less. Another is to change the inflation peg to slow the growth of those initial benefits. What do you prefer?

You could do a little bit of each. Most economist think CPI overstates the true rate of inflation. Reduce that a bit, and you save some money without having losing the idea of inflation adjusting. People on the left would say seniors' buying habits are different from younger people because they buy more health care, which has high inflation. It's a valid point. I would not recommend an enormous reduction in COLA.

You prefer cutting smaller checks to the wealthy?

Yes. I would put lion's share of benefit reduction on initial benefits for high income people. They're already saving more for retirement. If you reduce their expected benefits, they can make it up on their own with savings.

On the tax side, what do you think about raising the ceiling of taxable income or raising the rate of taxation?

I'd prefer we not. Income tax rates are going up and another 12 percent tax on money over the $107,000 ceiling is not an inconsequential tax change.

What kind of Social Security deal do you think we're going to get from the deficit commission?

My guess is benefit reductions rather than tax increases. I suspect the package would include an increase in retirement age, an increase in taxable maximum wage, and a benefit cuts for higher earners. I don't know whether they'll do a COLA change, but it would be modest anyway.

What might the commission not propose that it should?

I think they should and can try to encourage broader retirement savings outside of Social Security. USA accounts, automatic IRAs and 401(k)s. So when you start a job, you're auto get enrolled in a 401(k). It would be the default position, and you get a tax subsidy and an employer subsidy. That's the way to go.

Andrew G. Biggs is a resident scholar at AEI.

A READER ON THE STATE OF THE POLITICAL DECAY AND IDEOLOGICAL GRIDLOCK BETWEEN ONE GROUP WHO SEEK TO DESTROY THE COUNTRY, AND THOSE WHO WANT TO RESTORE IT.

The Rise and Fall of Hope and Change

Alexis de Toqueville

The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money.

Alexis de Tocqueville

Alexis de Tocqueville

The United States Capitol Building

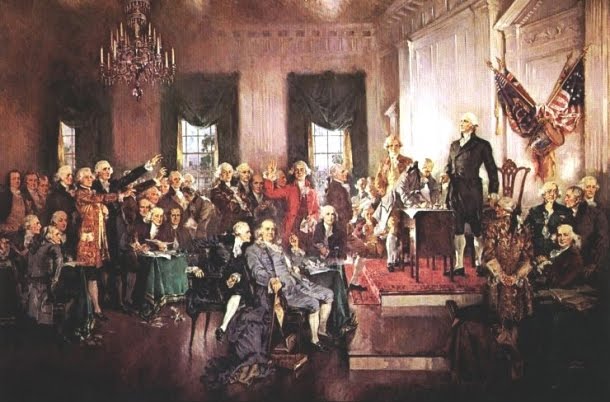

The Constitutional Convention

The Continental Congress

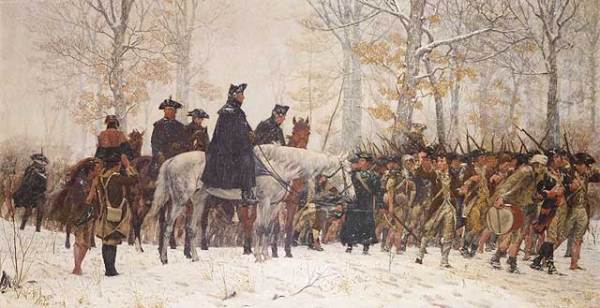

George Washington at Valley Forge

No comments:

Post a Comment