from The Chicago Sun-Times:

Being broke costs state $550 million

BAD BOND RATING

Borrowing money has gotten a lot more expensive

Comments

August 30, 2010

BY DAVE McKINNEY Sun-Times Springfield bureau chief

SPRINGFIELD -- The state's miserable bond rating has driven up borrowing costs for state government by more than $500 million since last year, a government watchdog group says.

The nonpartisan, Chicago-based Civic Federation analyzed the near-record borrowing that the state has undertaken since last September and looked at similar borrowing during the same period in other states that have higher bond ratings than Illinois.

» Click to enlarge image

The most borrowed during any 12-month period in Illinois history came under ousted former Gov. Rod Blagojevich

(Dom Najolia/Sun-Times)

The result was a staggering $551.3 million extra that state taxpayers are having to devote to support the state's thirst for debt because of a series of rating downgrades, the group says in a report being released today.

"This is an actual quantification of what the cost of the state's fiscal irresponsibility has been because of the Illinois General Assembly and governor's failure to stabilize state finances and to allow our credit rating to drop so low we are now the lowest credit-rated state in the country, with California," said Laurence Msall, the Civic Federation's president.

Since September 2009, the state has borrowed $9.6 billion, which is the second-largest borrowing spree in state history. The most borrowed during any 12-month period in Illinois history came under ousted former Gov. Rod Blagojevich, who signed off on a $10 billion borrowing plan in 2003 to shore up the state's underfunded retirement systems.

Illinois' credit rating has been downgraded four times by one bond-rating agency in the past 18 months because of the state's record budget deficits, its underfunded pension liabilities, revenue shortfalls, spending jumps and debt increases.

"If the state had acted appropriately when the Great Recession began and we saw revenues decline, and if we'd have cut spending to match revenues, it's likely we wouldn't have had so many downgrades, and in this one year, we'd saved over $550 million in borrowing costs," Msall said.

Because of the way the $9.6 billion is spread over three decades, the state won't pay all $551.3 million in one year. But $72.9 million will have to be paid in 2011, while $301.2 million of the overall amount will have to be paid over the next five years, the group said.

"The failure of Illinois government to stabilize its finances means Illinoisans will be forced to pay more for their government while it delivers fewer services," Msall said.

A READER ON THE STATE OF THE POLITICAL DECAY AND IDEOLOGICAL GRIDLOCK BETWEEN ONE GROUP WHO SEEK TO DESTROY THE COUNTRY, AND THOSE WHO WANT TO RESTORE IT.

The Rise and Fall of Hope and Change

Alexis de Toqueville

The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money.

Alexis de Tocqueville

Alexis de Tocqueville

The United States Capitol Building

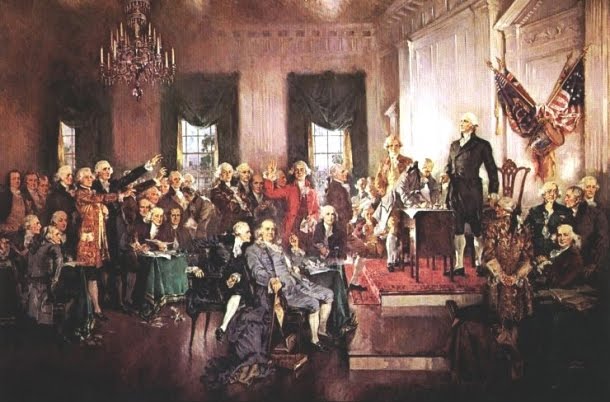

The Constitutional Convention

The Continental Congress

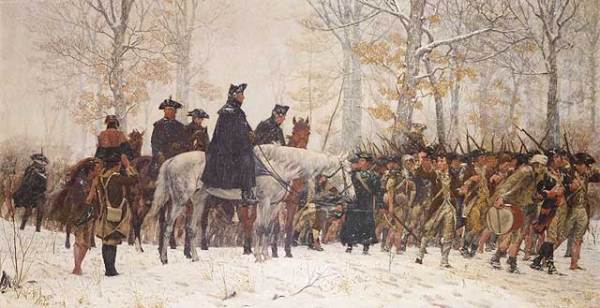

George Washington at Valley Forge

No comments:

Post a Comment