From The American Spectator:

After the "Recovery Summer"

By Joseph Lawler on 9.3.10 @ 11:35AM

The Washington Post reported this morning that the White House is considering a payroll tax cut and an extension of the research and development tax credit, with the intention of aiding small businesses.

It's a sign that the Obama economic team is worried enough about the sluggishness of the recovery and the possibility of a double-dip recession to act on Republicans' terms. The only fiscal stimulus bill the Democrats could pass would be one composed of tax cuts. Republicans would block any sizable spending measures, as they have been doing.

The Post suggests that the bill would be introduced before the midterm elections. The article quotes William Galston of the Brookings Institution explaining that the timing proves that the decision wouldn't be motivated by fears about the midterms: "Substantively, there is nothing they could do between now and Election Day that would have any measurable effect on the economy. Nothing."

If the idea is to make it easier for companies to hire new workers in an attempt to revive the weak labor market, a payroll tax cut would be a good first step. The administration, however, is also toying with a few other policies that would undermine the effect of the payroll tax cut. For example, if the Democrats do allow the Bush tax cuts for top individual earners to expire, the burden will fall onto small business owners -- counteracting the effect of the payroll tax cuts mere months after they're implemented.

Kevin Hassett and Alan Viard had a good explanation of this argument in today's Wall Street Journal:

The numbers are clear. According to IRS data, fully 48% of the net income of sole proprietorships, partnerships, and S corporations reported on tax returns went to households with incomes above $200,000 in 2007....

It's clear that business income for large and small firms will be hit by the higher tax rates. And in point of fact, firms of all sizes contribute to the nation's prosperity. So it's a mistake to focus only on the impact of increased tax rates on small business. But will the higher rates actually cause a significant reduction in business activity?

Economic research supports a large impact. A pair of papers by economists Robert Carroll, Douglas Holtz-Eakin, Harvey Rosen and Mark Rider that were published in 1998 and 2000 by the National Bureau of Economic Research analyzed tax return data and uncovered high responsiveness of sole proprietors' business activity to tax rates. Their estimates imply that increasing the top rate to 40.8% from 35% (an official rate of 39.6% plus another 1.2 percentage points from the restoration of a stealth provision that phases out deductions), as in Mr. Obama's plan, would reduce gross receipts by more than 7% for sole proprietors subject to the higher rate.

These results imply a similar effect on proprietors' investment expenditures. A paper published by R. Glenn Hubbard of Columbia University and William M. Gentry of Williams College in the American Economic Review in 2000 also found that increasing progressivity of the tax code discourages entrepreneurs from starting new businesses.

Because marginal tax rate increases impede long-run growth, they should be avoided in good times and bad. But now is a particularly inopportune time to raise rates, as small businesses are still struggling from the recession.

A READER ON THE STATE OF THE POLITICAL DECAY AND IDEOLOGICAL GRIDLOCK BETWEEN ONE GROUP WHO SEEK TO DESTROY THE COUNTRY, AND THOSE WHO WANT TO RESTORE IT.

The Rise and Fall of Hope and Change

Alexis de Toqueville

The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money.

Alexis de Tocqueville

Alexis de Tocqueville

The United States Capitol Building

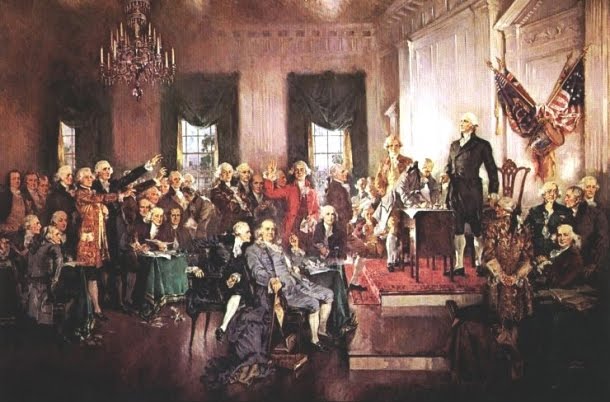

The Constitutional Convention

The Continental Congress

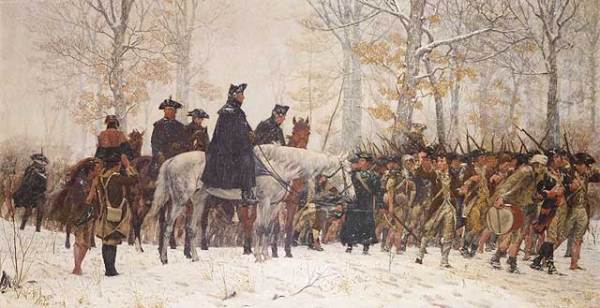

George Washington at Valley Forge

No comments:

Post a Comment